PMJJBY

- PMJJBY is an insurance scheme offering life insurance cover for death due to any reason. It is a one-year cover, renewable from year to year.

- The age group of 18 to 50 years are entitled to join. In case of multiple bank accounts held by an individual in one or different banks/Post office, the person is eligible to join the scheme through one bank account only. Aadhaar is the primary KYC for the bank account.

- Rs. 2 lakh is payable on member's death due to any cause.

- Premium: Rs. 436/- per annum per member. The premium will be deducted from the account holder's bank account through 'auto debit' facility in one instalment, as per the option given, at the time of enrolment under the scheme. The premium would be reviewed based on annual claims experience.

PMSBY

- PMSBY is an Accident Insurance Scheme offering accidental death and disability cover for death or disability on account of an accident. It would be a one-year cover, renewable from year to year.

- The age group of 18 to 70 years in participating banks will be entitled to join. Aadhaar would be the primary KYC for the bank account.

- Coverage includes Rs. 2 lakh for accidental death and full disability, and Rs. 1 lakh for partial disability.

- Premium: Rs. 20/- per annum per member. The premium will be deducted from the account holder’s bank account through 'auto debit' facility in one instalment on or before 1st June of each annual coverage period under the scheme. However, in cases where auto debit takes place after 1st June, the cover shall commence from the date of auto debit of premium by Bank. The premium would be reviewed based on annual claims experience.

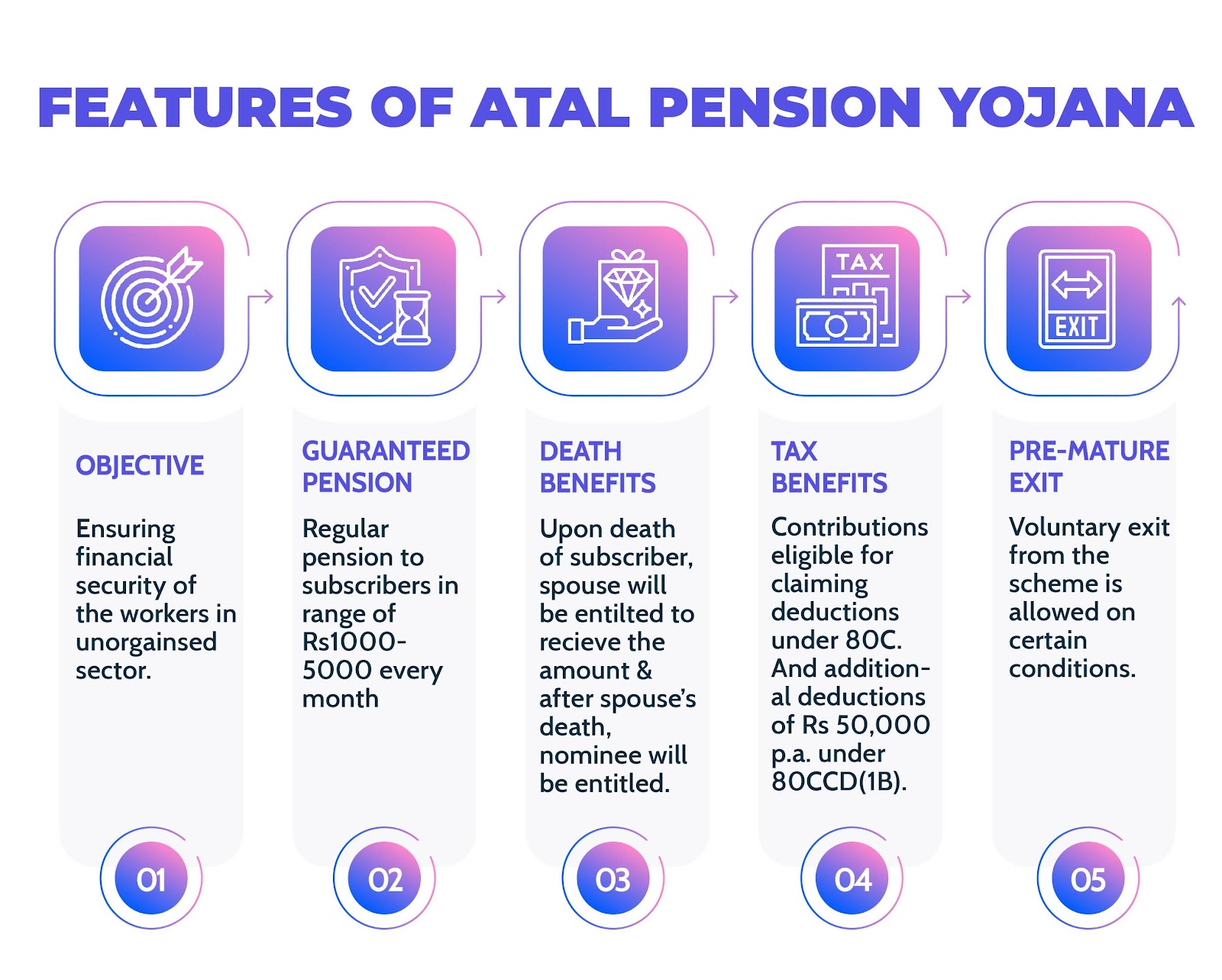

Atal Pension Yojana (APY)

APY is open to all citizens of India who have a savings bank account. The minimum age of joining APY is 18 years and maximum age is 40 years.

Under the APY, will receive monthly payments from their accrued corpus. If a beneficiary passes away, the pension payments will be made to their spouse. In the event of both the beneficiary and their spouse’s death, a lump sum payment will be made to the nominee.

- Pension Amount Up to Rs.5,000

- Contribution Period Minimum 20 years

- Exit Age 60 years

The Atal Pension Yojana (APY) scheme was announced by the Government of India in the 2015-2016 budget with the purpose of helping individuals who are working in the unorganised sector.

- Tax benefits are provided

- The Indian Government co-contributes towards the scheme

- Risk-free scheme